By Hung Tran

Since Russia launched a military invasion of Ukraine, the entire European security order seems to have been thrust into question.

In addition to the first round of US, British, and European sanctions—which include restrictions on Russian financial institutions and a suspension of the Nord Stream 2 natural gas pipeline—more extensive and stringent sanctions will be announced. These measures are bound to have global political and economic consequences. As Russia takes steps to retaliate against sanctions and the war in Ukraine could damage gas pipelines, an acute energy shortage is possible, leading to a global economic slowdown, but most severe in Europe, amid a spike in global oil and gas prices.

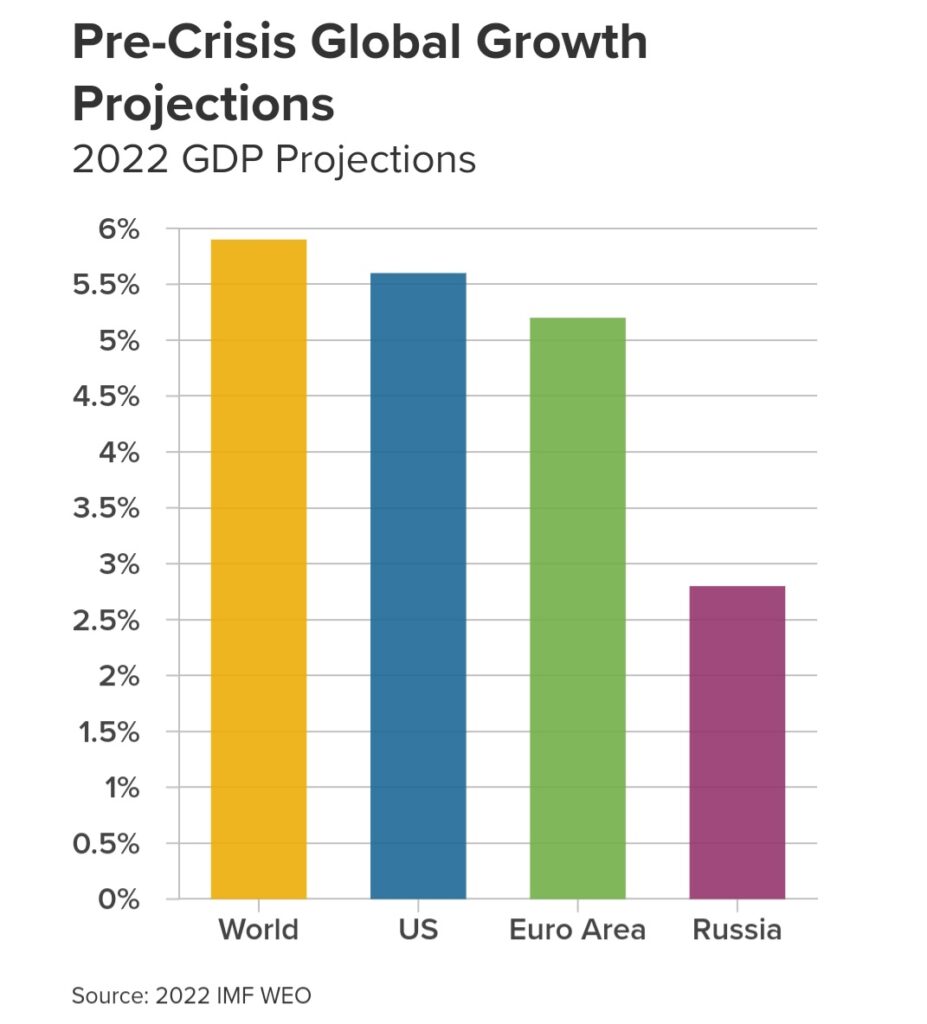

But increased production and new sources will offset the impact in a few months. Russia’s modest contribution to the global GDP—just 1.7 percent—means the world’s economic pain will pass even though the fallout of the invasion will define geopolitics for years.

Pouring oil on troubled waters

Wanting to avoid plunging American allies into an energy and economic crisis, the additional sanctions may avoid banning Russian deliveries of gas (accounting for 40 percent of European imports) and crude oil (more than one-third of European imports)—or at least avoid a complete ban.

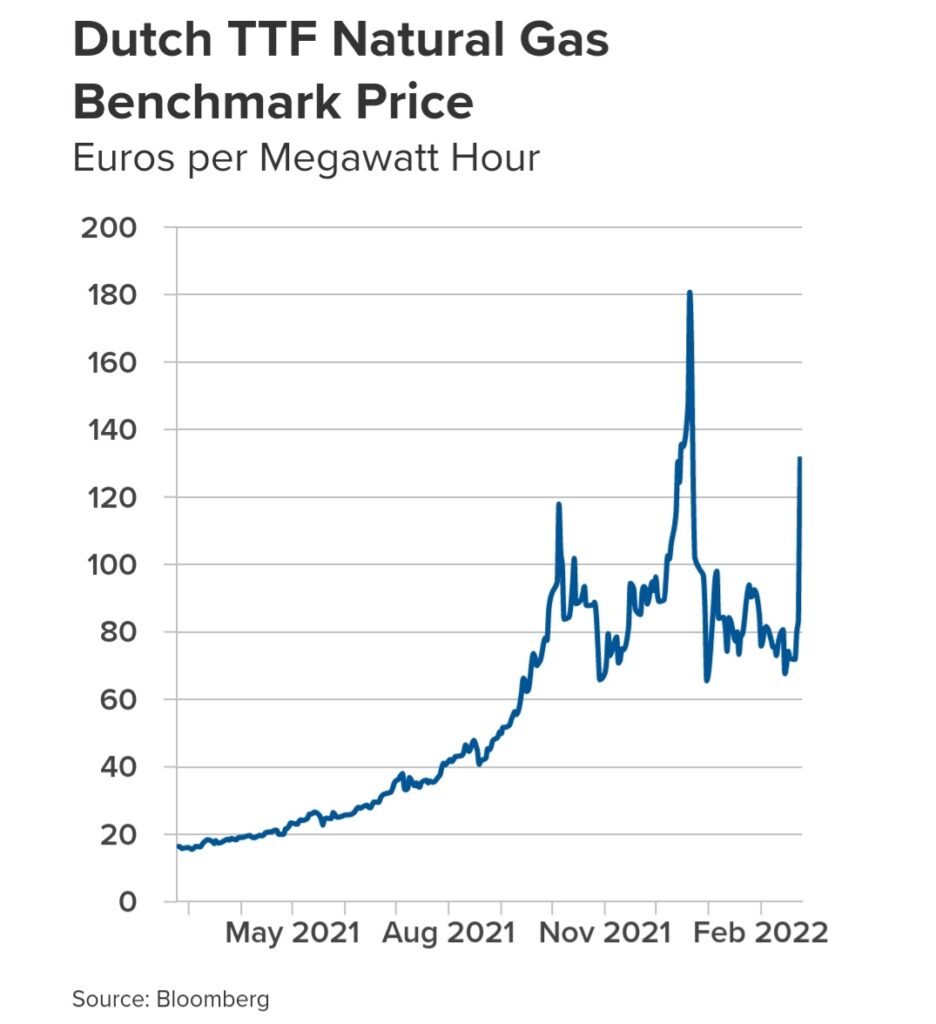

Any disruption in energy supplies will come against the backdrop of already volatile gas prices in Europe, which by one measure shot up eleven-fold last year to $212 per megawatt-hour. Russia could respond to sanctions by further reducing deliveries to the spot markets. It could attempt to divide Europe by sparing Germany while cutting supply to countries like Poland and Lithuania, which have been more active in supporting Ukraine.

The good news? Europe is already diversifying its energy sources. So far in 2022, European gas prices have fallen back to around $85 thanks to liquified natural gas (LNG) imported from Asia. In the past month, US LNG deliveries to Europe have exceeded pipeline deliveries from Russia for the first time. Moscow, for its part, is unlikely to stop supplies entirely for fear of seriously damaging its reliability as a long-term energy source.

Meanwhile, high gas prices have prompted a partial switch to oil, reinforcing a rebound in demand following a relaxation of COVID-19 restrictions. After the invasion took place, crude oil prices have jumped above $100 per barrel. In addition, J.P. Morgan predicts that oil prices could rise to $150 per barrel if Russia halves its energy deliveries to Europe in response to sanctions. Yet even in the worst-case scenario, the likely impact will be less severe than the 1973 OPEC oil embargo that led to a quadrupling of oil prices and a significant tightening of US monetary policy (which was followed by a recession).

Rising oil prices will also encourage more production. Saudi Arabia and the United Arab Emirates can produce an extra 3.5 million barrels per day. The United States can also produce more, having become the world’s top oil and gas producer in 2021. The International Energy Agency (IEA) estimates that global oil supply will soar by 6.2 million barrels per day on average in 2022, compared to an increase of 1.5 million barrels per day in 2021. That’s why the global oil market should tip back to surplus later this year—unwinding the upward price pressures.

Precious commodities

Besides affecting energy, Russia’s invasion could also disrupt supplies of other important commodities including titanium (used in airplanes), palladium (used to make catalytic converters), neon (from Ukraine, used to make semiconductors), and wheat (Russia is the world’s largest exporter). This would push up their prices.

Indeed, rising energy and commodity prices will keep inflation rates higher for longer, and growth slower amid heightened uncertainty. This will pose a dilemma for many central banks. In January, the International Monetary Fund cut its 2022 growth estimates for the world by 0.5 percentage points (ppt) to 4.4 percent. The organization slashed the expected US growth rate by 1.2 ppt to 4 percent, while raising the consumer inflation estimate for advanced economies by 1.6 ppt to 3.9 percent.

Post-invasion spikes in energy prices could lead to a further downward revision of growth estimates while raising expectations of inflation. Persistent high inflation rates will add pressure on the US Federal Reserve—already perceived to be behind in taking timely measures in response to rising prices—to tighten monetary policies soon. However, the task of central banks has been made more complicated and difficult as stock markets worldwide have plummeted on news of the invasion, reinforcing the slowing down of economic activity.

The long game

To be sure, the West’s renewed preoccupation with Russia and Ukraine could give China more breathing room to undertake aggressive actions in the Indo-Pacific that might aggravate already tense relations with the United States. Stepped up hybrid warfare, especially cyberattacks, by China and Russia can be expected, threatening critical functions and installations in Western countries as well as interfering in their elections.

Europe will need to suffer increased prices for oil and gas because of the Russian invasion of Ukraine and the resulting Western sanctions. But eventually, higher prices will induce more production to relieve upward price pressures. If Europe uses this moment to truly diversify its energy sources, it could insulate itself from future shocks planned by the Kremlin.

That might be smart since the current crisis risks crystallizing the tussle between the West and a Russia-China axis into a new Cold War—with a hot war in Ukraine which could threaten to spread to surrounding countries which are members of NATO. This is a perilous moment for the world.

Hung Tran is a nonresident senior fellow at the Atlantic Council GeoEconomics Center, and former executive managing director at the International Institute of Finance and former deputy director at the International Monetary Fund.

Credit | The Atlantic Council