•EU, US and allies consider ban on Russian crude

Jude Johnson with Michael Kern

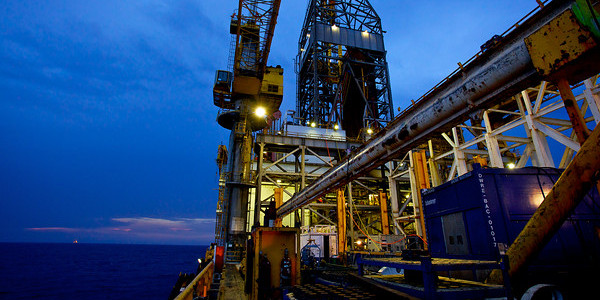

Nigeria and Organization of the Petroleum Exporting Countries (OPEC) are set to benefit from the soaring oil prices due to the ongoing Russian invasion of Ukraine and subsequent sanctions by the United States, European Union and their allies.

But experts have warned that Nigeria may not fully reap the benefits of the increasing oil price due to the prevailing subsidy regime and lack of domestic crude oil refining capacity.

According to report by Oil Price, the United States has confirmed that it is in talks with European allies to potentially sanction Russian crude oil in response to Moscow’s ongoing aggression in Ukraine, sending oil prices briefly above $130.

US Secretary of State Antony Blinken noted on Sunday during the NBC talk show Meet the Press on Sunday, “We are now in very active discussions with our European partners about banning the import of Russian oil to our countries, while of course at the same time maintaining a steady global supply of oil.”

The latest considerations follow a stream of sanctions that have already had a significant impact on the Russian economy but have not yet been able to halt Putin’s advance into Ukraine.

European Commission President Ursula von Der Leyen has yet not fully supported the idea as of yet, though she has expressed that one of their primary goals in the sanctions that have been levied thus far is to cut Putin’s funding streams.

The European Commission President noted on CNN, “The goal is to isolate Russia and to make it impossible for Putin to finance his wars,” adding “For us, there is a strong strategy now to say we have to get rid of the dependency of fossil fuels from Russia.”

The move, if agreed upon, has long been considered the “nuclear option” as a ban on Russian oil could weigh on global supply in an already tight market.

Bank of America analysts noted that if Russia’s oil is cut off, the market could face a 5 million barrel shortfall which could push oil prices to $200 per barrel.

The situation is compacted by stalling talks with Iran over a potential new nuclear deal.

Amrita Sen, the co-founder of Energy Aspects, a think tank, explained, “Iran was the only real bearish factor hanging over the market but if now the Iranian deal gets delayed, we could get to tank bottoms a lot quicker especially if Russian barrels remain off the market for long.”

Credit | Oil Price