By Mary Hui

It was arguably three alphabetical letters — w, a, n — that sparked a fierce diplomatic showdown and trade dispute between China and Lithuania.

Last November, Taiwan opened a de facto embassy in the Lithuanian capital of Vilnius using its own name. Elsewhere around the world, its representative offices bear the name Taipei to sidestep references to the de facto nation that China claims as its own territory. But Vilinus’s decision to allow that simple name change, from “Taipei” to “Taiwanese,” was enough to spark a blockage of Lithuanian goods by Chinese customs and a Beijing-led corporate boycott of multinationals with ties to Lithuania.

Much hangs in the balance. Will Beijing pile on the pressure to force Vilnius to back down? Will Lithuania stand firm in its support for Taiwan, earning Taiwan a key diplomatic ally in the European Union? And will the EU show solidarity, making it clear to China that it won’t tolerate economic coercion against any bloc members?

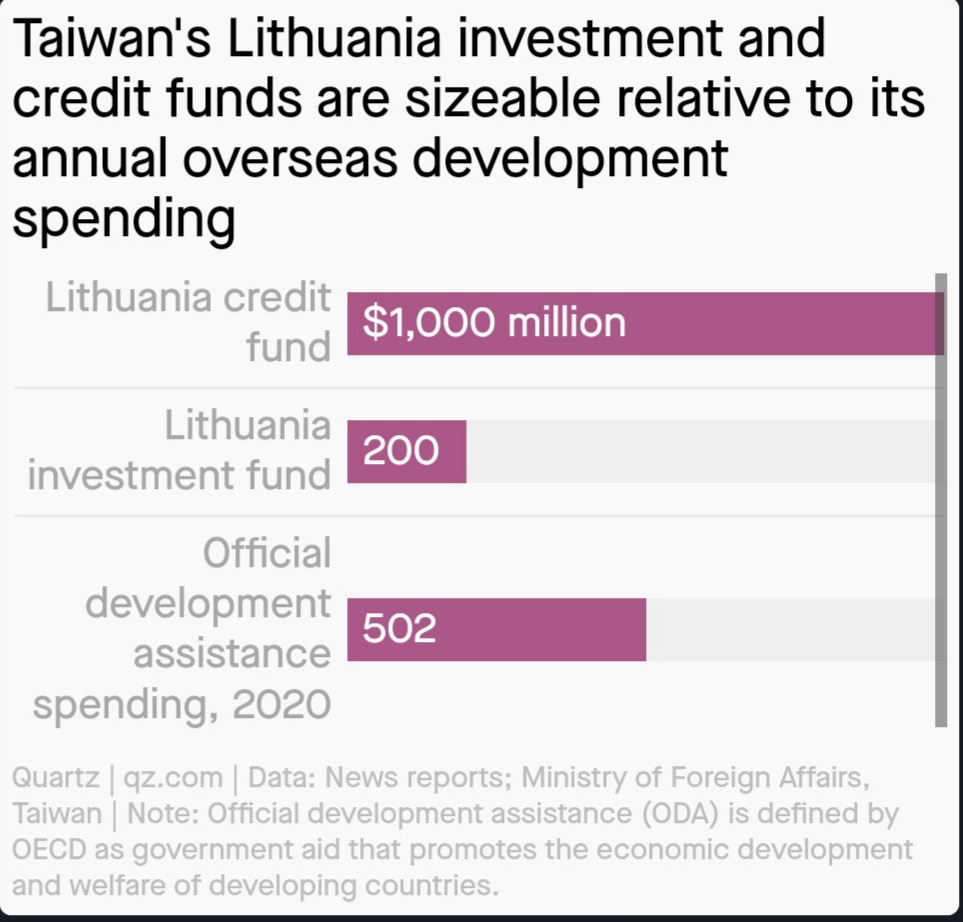

Now, with Taiwan’s pledge this month to set up a $1 billion credit fund to finance Lithuanian projects, on top of a $200 million investment fund it announced just days prior, Taiwan is wagering that well-timed and precise deployments of economic tools can bring about significant diplomatic gains. Whether that bet pays off, however, may well depend on factors far beyond Taiwan’s control.

“This is a very careful game to be played at the moment and it’s still not clear who in the end will benefit,” said Janka Oertel, director of the Asia program at the European Council on Foreign Relations.

“For China, it’s relatively easy to hold the pressure up and see who will fold. For the Europeans, it’s going to be a huge challenge to maintain unity in light of huge pressure but the incentives are high,” she said. And for Taiwan, “enhancing relations with a EU state, no matter how small, is significant.”

Are Lithuania’s chip ambitions realistic?

While the investment plans for Lithuania have yet to be finalized, Taiwan’s minister for national development has said the $1 billion loan fund will focus on a number of strategic areas including semiconductors, biotechnology, satellites, finance, and scientific research.

The $200 million investment fund may seem like a drop in the bucket compared to the $44 billion capital expenditure budget that homegrown chip titan Taiwan Semiconductor Manufacturing Company (TSMC), has earmarked for 2022, it’s actually a sizeable amount relative to Taiwan’s annual spending on international cooperation and development programs.

According to the latest official figures, Taiwan spent $502 million in 2020 on official development assistance, defined by the Organization for Economic Co-operation and Development (OECD) as government aid that promotes economic development and welfare in developing countries.

For Lithuania, the prospect of building a semiconductor industry with help from the world’s leading chipmaker is being embraced at the highest levels.

In an emailed response to questions, Lithuania’s ministry of economy and innovation said the country “has a strong interest in creating a Lithuanian semiconductor manufacturing ecosystem and to cooperate with Taiwan, which is one of the most important players in the global semiconductor market.” It added that partnering “with one of the most advanced economies in the world can open up huge opportunities for Lithuanian high added value sectors” including chipmaking.

But it’s not clear that there’s actually a strong business case for establishing a highly capital-intensive chip industry in Lithuania—or for that matter the EU.

“TSMC is perhaps thinking, ‘Do we really need to go to Europe?’” said Hosuk Lee-Makiyama, director of the European Centre for International Political Economy. “Of course [European telecommunication-equipment manufacturers] Ericsson and Nokia, these companies are huge. But have they actually demanded that TSMC needs to move closer?” Quartz has reached out to TSMC for comment.

But Lithuania does offer a key competitive advantage, argues Misha Lu, a Taiwan-based semiconductor analyst: a leading laser industry, which can help in the manufacture of more efficient photonic chips. As developments in fields like big data, artificial intelligence, and the metaverse increase demands on data transmission speeds, silicon photonic chips—which use photons as opposed to the electrons in traditional electronic chips—offer greater efficiency and bandwidth.

This is where Lithuania’s laser industry comes in: laser plays a crucial role as the light source in silicon photonics.

“Lithuania has the talents…thanks to its laser industry, and Taiwan has little in comparison, including TSMC,” Lu said. “That’s where both countries can cooperate: Taiwan has the key silicon-based semiconductor manufacturing process to scale up production economically, while Lithuania has the talents for photonics.”

For instance, the Vilinius-headquartered Brolis Defence Group specializes in silicon photonics and high-precision semiconductor fabrication methods. Currently, about one-third of Lithuania’s laser exports go to China, while only 2% go to Taiwan. Closer Lithuania-Taiwan ties could mean far greater laser sales to Taiwan, Lu noted.

https://datawrapper.dwcdn.net/7VNIm/1/

Meanwhile, TSMC is building fabs in Arizona and Japan, and is considering setting up its first European chip plant in Germany. Just this week, the European Union unveiled draft legislation that would boost chip production across the bloc. However, some analysts have cautioned against Europe’s push for advanced chip fabs, arguing that the continent needs to invest in chip design first.

Translating TSMC’s power into diplomatic gains

Taiwan’s strategy of using its economic power to advance diplomatic objectives dates back to the 1960s, when it was able to market its success in improving agricultural productivity to many other developing nations in Southeast Asia, Latin America, and Africa, said James Lin, a professor of history at the University of Washington. Over the years, directing aid and technical assistance in both agriculture and industry to other nations helped Taiwan build diplomatic goodwill.

But as China’s economy grew from the 1970s onwards, its economic heft increased relative to Taiwan, dampening Taiwan’s ability to wield its economic power on the global diplomatic stage. At the same time, Taiwan also propelled China’s economic rise as Taiwanese firms moved production to China just as the latter was seeking foreign investment. Ultimately, Beijing was able to win its “diplomatic war” against Taiwan—wooing away official allies who recognize Taiwan as a sovereign nation—in large part because of its use of foreign aid and investments, argues John Copper, emeritus professor of international studies at Rhodes College, in his book China’s Foreign Investment Aid and Diplomacy.

“When Taiwan was an economic success story and China was not and Taiwan could afford to give as much or more aid than China, to some extent this worked [to win diplomatic recognition],” Copper writes. “However, when China experienced rapid economic growth and accumulated massive amounts of foreign exchange Taiwan was unable to compete with China’s aid offer.”

But today’s geopolitical landscape, with growing recognition that like-minded countries need to band together to resist China’s economic coercion and aggression, could mean that Taiwan needs not compete with Beijing dollar-for-dollar on foreign aid and investment in order to win certain diplomatic gains. In addition, its chip prowess is an ace up its sleeve, given the supply shortage, and the extent to which the US, Europe, and China all rely on TSMC.

For instance, the current Lithuania-China trade dispute, and Taiwan’s demonstration of support for Vilnius, could create the impetus for the EU to finally hash out a free trade agreement with Taiwan, said Lee-Makiyama.

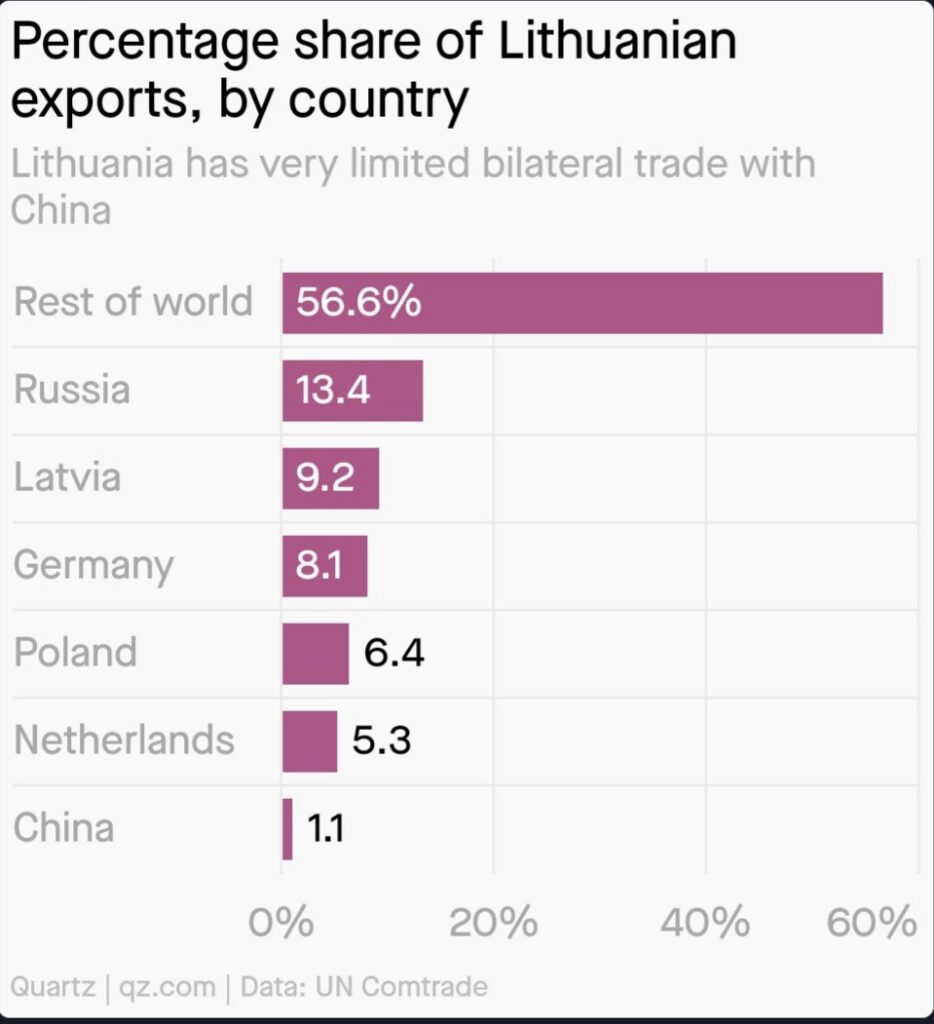

Meanwhile, Lithuania arguably has relatively little to lose in its fight with Beijing. It has limited bilateral trade with China, to which it sends barely 1% of its exports. And it has already pulled out of the Beijing-led 17+1 bloc, having been disappointed by supposed trade benefits that did not materialize.

What it could come down to, then, is whether the EU meaningfully rallies to Lithuania’s side. Already, EU high representative Josep Borrell has said the bloc has “clear solidarity” with Lithuanian in the clash over Taiwan.

“This is a very important test case to show that the Europeans can stand up to this when they still have leverage vis-a-vis China,” said Oertel, of the European Council on Foreign Relations. “…If played well by the European side, this could be a huge asset.”

Credit | Quartz